Market Reports

Join our mailing list and be the first to receive our valuable market data and insights.

Edmonton Industrial Property Market Report, August 2023

Overview

It’s been a turbulent ride for industrial use property over the last three years as oil & gas plunged to record lows through the pandemic response and then reaching record highs at the onset of the Ukraine war. Distribution also became a major priority during…

Overview

It’s been a turbulent ride for industrial use property over the last three years as oil & gas plunged to record lows through the pandemic response and then reaching record highs at the onset of the Ukraine war. Distribution also became a major priority during the pandemic as it necessitated consumer delivery services and warehousing of supply. This has resulted in significant demand for industrial use space in both warehouse/distribution and oil & gas related property types.

Market Trends

New developments in market preferences and user necessity have advanced the industrial sector to a new era of demand and product requirements. Propelling this new era of industrial warehousing includes e-commerce, automation technology, sustainable designs, logistical improvement, and flexible space.

The growth of e-commerce has led to an increase in demand for warehousing & distribution property, as the need for last-mile delivery facilities that can quickly get products to customers has expanded at a rapid pace.

Automation & AI technology are transforming the industrial real estate sector as much as they are other industries. Smart warehouses and distribution centers are becoming increasingly necessary to compete and provide good service. Features such as robotics, artificial intelligence, and the Internet of Things (IoT) improve efficiency and reduce costs.

Many industrial real estate owners and tenants have started prioritizing sustainability in their operations. This includes incorporating energy-efficient features, such as solar panels and LED lighting, and implementing environmentally friendly practices, such as waste reduction and water conservation.

The COVID-19 circumstances have highlighted the importance of logistics and supply chain management. Industrial real estate properties that are well-located and well-equipped to support efficient and reliable supply chains are in high demand.

Industrial real estate users are increasingly seeking flexible spaces that can accommodate changing needs in an uncertain world. This includes spaces that can be easily reconfigured or expanded, and properties that offer a range of amenities and services, such as shared conference rooms and co-working spaces.

Insights

Alberta's industrial real estate market has historically been strong due in part to the province's natural resources, such as oil, gas, forestry, & rare minerals. Alberta’s topography also allows for excellent roadways, providing access to these natural resources, as well as transportation of goods across the province.

Tenant demand for industrial properties has remained robust, which has put upward pressure on rental rates. This has been driven by a range of factors, including a booming natural resource sector, growth of e-commerce, and the need for efficient supply chain & logistics operations. With a vast, relatively flat landscape, Alberta is well suited for industrial warehousing and manufacturing facilities. It affords lower acquisition prices and rental rates, making it an attractive destination for industrial real estate investors and developers looking to acquire or develop high-quality properties.

Energy scarcity perpetuated by the Russia-Ukraine war, has increased oil & gas prices to a profitable level for Alberta. Political & economic relations with Russia are expected to remain strained into the foreseeable future, which opens opportunity for Alberta to provide energy to Europe and Global markets that have boycotted Russian resource exports. However, to what extent our resources will be available will largely depend on the regulatory and political barriers preventing Alberta’s resources from getting to market.

Market Conditions

Although the Government of Canada has repeatedly said that the economy is strong, this statement is misleading the public. Canada’s economy has largely stagnated, as economic growth has declined dramatically in recent years, and a trend that is likely continue into the foreseeable future. Excessive population growth through immigration, increases in federal spending, and money printing have created a pseudo increase in GDP. In actuality, growth in real incomes and living standards has stalled. Between 2016 & 2019 and through the last year, in almost every measure of economic growth the Canadian Government has failed to gain ground. GDP per person was stagnant and continues to stagnant post pandemic. Business investment from 2014 to 2021 declined 20% and is only equal to 55% of US levels. Much of this investment decrease is due to the decline in the oil & gas industry within Alberta, which has been largely responsible for new innovation and investment projects in the country. Investment into Alberta has returned with more favourable oil & gas prices, but the investment has not returned to the same extent, as there are significant political, regulatory, and logistical uncertainties that are hindering investment into the province.

Alberta’s economy, however, continues to perform well relatively to the rest of the country and the western world. Various economic indicators are as follows:

The West Texas Intermediate (WTI) price of oil, often a world reference price quoted in the media, appears to be holding around $70 - $80/bbl USD. Oil production in Alberta was 19.01 million cubic metres in March 2023, up 3.3% from the year prior, indicating steady production in the province. Since then, the Suncor facility has shut down for maintenance decreasing production, however this will only be temporary.

In June 2023, Alberta's seasonally adjusted unemployment rate was 5.7%, a minor increase of 0.5% from last year, down 0.3% from January. Alberta had $340B in GDP in 2022, which is the second largest increase in GDP within Canada at 5%. Non-residential capital investment in Alberta increased by 14% in 2022 to $63B.

In the first quarter of 2022, net migration into Alberta was 51,718, compared to 16,821 in the same quarter of 2022, which had similar figures as 2015 to 2019, an increase of 252.5%. Nationally, net migration was 340,666 in the third quarter of 2022 compared to 175,633 in the same quarter of 2021. Net international migration into Alberta was 35,932 a 200% increase, while net interprovincial migration was 15,786 a 225.5% increase from the year before.

In Alberta, urban housing starts totalled 2,368 in June 2023, a year-over-year decrease of 29.2%.

There were $4.1B worth of homes sold in Alberta through the Multiple Listing Service (MLS), up 6.3% from June 2022. Alberta recorded $1.9B in building construction investment, a decrease of 19.6% from May 2022. In May 2023, Alberta municipalities issued $1.3B in building permits, a decrease of 13.8% from May 2022.

On a year-over-year basis, Albertans paid 1.9% more in for the goods and services that comprise the Consumer Price Index (CPI) than in the same month a year ago, Alberta’s CPI appears to be back to stabilized levels.

After reducing the overnight interest rate to 0.25% in 2020, the Bank of Canada has since raised the overnight rate to 5% effective on July 12, 2023. As the economy ramps up again, the effects of an increased money supply from government handouts and global supply-chain issues have taken centre stage as inflation hit a thirty-year high of 8%. Since then, reported CPI is down to 2.8%, which is on par with projections. It is unclear whether the BoC will raise the rate further.

Forecast

Alberta is in a good position to weather the coming recession if it can resist federal overreach regulations and can get its products to the markets that desperately need them, such as Europe. Oil prices are expected to remain above $70/bbl USD for some time as the globe reorients its energy supply-chains, which bodes well for the Alberta’s energy sector and royalty revenue. However, a lack of investment due to political and regulatory uncertainty has limited the economic potential of the province and its industries. Positive economic indicators such as a strong job market and population growth has also contributed to increased need for industrial properties, which are expected to continue. Rising interest rates have led to higher borrowing costs but have not appeared to significantly slow growth in the market.

Price Trends

Industrial price increases have been seen across the region, and demand for the property type appears to be unwavering. However, new product continues to be constructed and absorbed, which has kept prices from escalating by considerable margins, maintaining a healthy market equilibrium.

Transactions

YEAR AMOUNT NO.

2020 $325,388,652 145

2021 $699,599,472 189

2022 $792,561,236 232

2023 $374,814,605 82

The above chart indicates that industrial sale volumes in Edmonton have been steadily increasing since 2020, with 2023 likely on par with 2022 figures.

Vacancy

CBRE is reporting that vacancy rates dropped 20 basis points in Q2 of 2023 from the previous quarter to 2.8% the lowest it’s been since 2015. This taken into context with 1.4M sq.ft. of new supply entering the market this quarter, indicates a strong demand for industrial use space.

Nisku/Leduc display the highest vacancy at 3.8%. Although this represents a below average vacancy, this market is still catching up from overdevelopment prior to 2015 and the subsequent fallout from the oil price collapse.

Acheson is showing the lowest vacancy at 0.4%. It’s low tax expense and diversification of product has allowed it to maintain a relatively low vacancy over the last two decades.

Absorption

According the CBRE, the industrial market saw 1.3M sq.ft. of positive absorption through the second quarter of this year with over 800,000 sq.ft. pre-leased new supply, indicating that participants are eager to move into new, suitable space.

Despite having higher vacancies, the Nisku/Leduc market area experienced 962,000 sq.ft. of positive absorption, demonstrating the increase in activity in the area.

Cap Rates

Industrial capitalization rates have remained relatively stable throughout the last few years in spite of unsettled interest rates and uncertain economic conditions. The increased need for warehousing and low interest-rates maintained demand for the property type through 2022, stabilizing cap rates. Into 2023, the increase in oil & gas prices led to a flourishing of occupant activity, increasing prices and putting downward pressure on caps. Simultaneously, the excessive increase in interest rates have dampened prices and put upward pressure on cap rates. Risk in the sector is relatively low due the continued prospects of warehousing necessity and high energy prices, which has brought greater attention from investors looking for stable returns and a place to park their money as an inflation hedge.

Edmonton proper: 6.5% - 7%

Greater Area: 7% - 7.5%

Lease Rates

Lease rates have seen a significant spread between high-quality new product and older lower quality product.

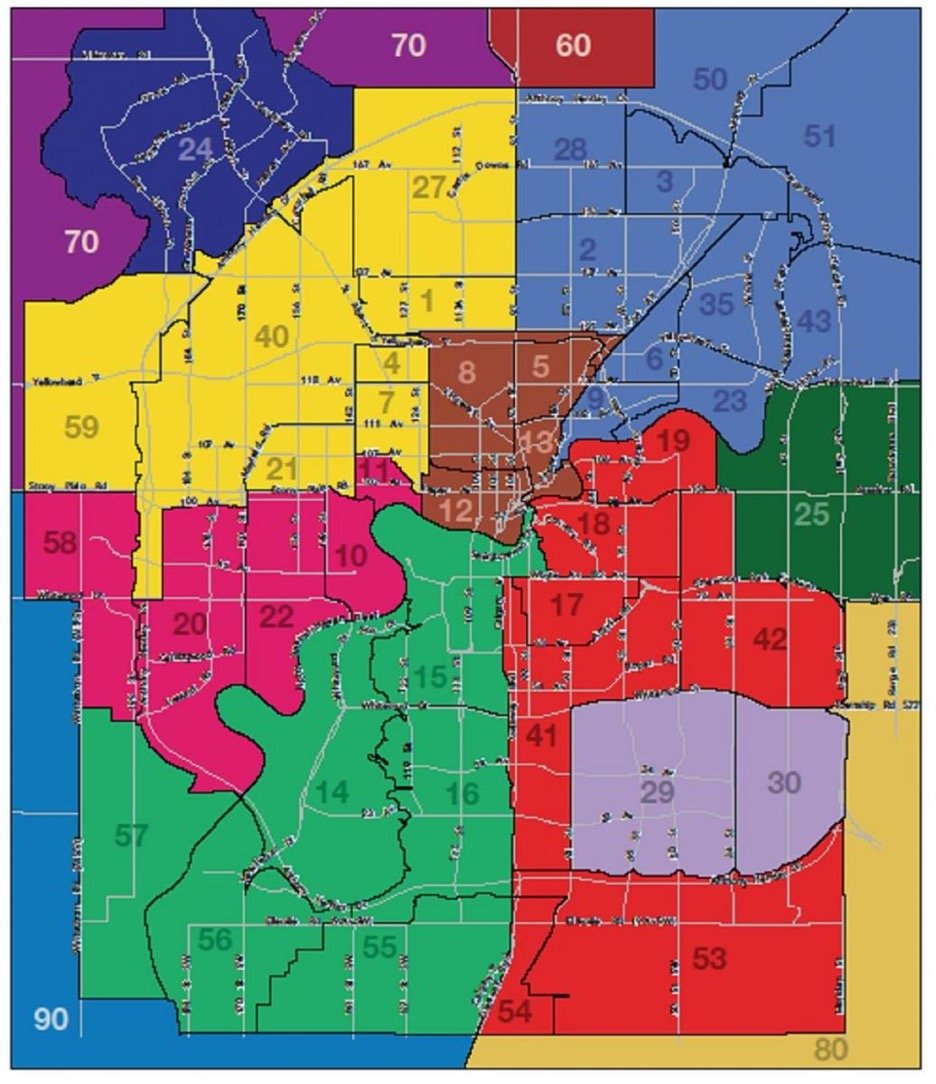

The following is a rental rate survey for various areas located on the “Edmonton Real Estate Zone Map.”

*These lease rates are an accurate representation of the general area but may not be accurate to a specific property within the area.

*Lease ranges are largely dependent upon the age, condition and amenities displayed on the property.

*Lease rates are on a price per square foot & triple net basis.

Edmonton Real Estate Zone Map

NORTH CENTRAL

Zone 5, 8

$7.50 - $12

CALGARY TRAIL

$10

EAST CENTRAL

Zone 17, 18, 19

$10 - $11

WEST

Zone 20, 21, 22

$12

NORTHWEST

Zone 1, 27, 40

$8 - $12

NORTHEAST

Zone 23, 28, 35, 43, 50, 51

$13.50

PARSON & CALGARY TRAIL COMMERCIAL AREA

Zone 41

$9 - $15

SUMMERSIDE/ELLERSLIE

ZONE 53, 54

$15

ST. ALBERT

$11 - $14

SHERWOOD PARK

$13 - $16

SPRUCE GROVE

$12 - $15

LEDUC / NISKU

$7 - $12

Edmonton Multi-Family Property Market Report, February 2023

Overview

Since 2010, global investment in the multifamily sector has risen at an annual growth rate of 15.6%, putting it among the fastest-growing asset classes. Investors have flocked to the sector thanks to…

Overview

Since 2010, global investment in the multifamily sector has risen at an annual growth rate of 15.6%, putting it among the fastest-growing asset classes. Investors have flocked to the sector thanks to its mainly resilient qualities through volatile economic conditions, as well as the demographic and population trends which have underpinned demand. Nationally, rent growth continued to accelerate at a rapid pace through 2022 and investment volumes in the sector were significant.

As lenders assess their risk, the availability of debt has been an issue for real estate assets, which has affected liquidity across markets. However, lenders have favoured multi-family assets for their resiliency and have increased allocation to the sector.

Market Trends

Edmonton has been experiencing a shift in municipal policy over the last decade toward higher-density zoning ordinances and direct control permissions along major arterial roadways in the core of the city. The city wants to see higher-density development, and reduced urban sprawl, implementing plans for a 15-minute city policy. Coupled with this, parking requirements have also been relaxed and are at the discretion of the developer. These two bold regulatory changes will have a major impact on community occupants, neighbourhood aesthetics, and property values.

Insights

Immigration policy will have a major impact on the Canadian real estate market over the next decade. The Federal Government has announced a forecast of approximately 500,000 new immigrant permanent residences with an additional 500,000 non-permeant immigrants. This also does not include another 500,000 approved Ukrainian refugees, for a total of 1.5M immigrants over one year. This immigration policy will have a major influence on housing supply and with-it rental rates & property values. Alberta in particular has seen major net migration figures, which is reflected in the timely absorption of new multi-family product, which has led vacancies to remain stable despite many new apartment projects entering the market.

High-interest rates have pushed many participants out of the buying market and into the rental market, which has put significant upward pressure on rental rates, as well as multi-family property values. Higher interest rates have not stopped capital investment into the sector, as sale volumes have increased considerably year over year. Further, housing supply shortages and steady demand have made multi-family a sought-after commodity with investors looking for safe returns and portfolio stabilization. Interest rates have made it more difficult for smaller players to enter the market, which has put even greater pressure on supply, however, larger players appear to be eager to fill the gap. The need for housing across Canada is astronomical and it appears this need will continue into the foreseeable future.

Market Conditions

Construction costs have seen significant destabilization over the last few years, however, despite some supply chain issues regarding China and Eastern Europe, the price of most building materials has begun to stabilize. The price of lumber, for instance, has returned to pre-pandemic levels. Energy prices, interest rates, inflation, and labour shortages will be key factors for costing over 2023, all of which appear to have somewhat stabilized and/or are coming down. A tight labour market and skill shortage are still an issue for contractors; however, many of these labour vacancies should be filled with an increase in immigration over the coming year and into the anticipated future.

The West Texas Intermediate (WTI) price of oil, often a world reference price quoted in the media, appears to be holding around $75/bbl USD, which has somewhat stabilized shipping costs. Oil production in Alberta was 18.9 million cubic metres in November 2022, up 2.9% compared to November 2021, indicating a steady ramp-up in production in the province.

In January 2022, Alberta's seasonally adjusted unemployment rate was 6.0%, a decrease of 0.8 percentage points from January 2021, up 0.4 percentage points from December 2022.

In the third quarter of 2022, net migration into Alberta was 52,582, compared to 17,131 in the same quarter of 2021, which had similar figures as 2015 to 2019, an increase of 206.9%. Nationally, net migration was 340,666 in the third quarter of 2022 compared to 175,633 in the same quarter of 2021. Net international migration into Alberta was 33,297, while net interprovincial migration was 19,285.

In Alberta, urban housing starts totalled 2,010 in January 2023, a year-over-year increase of 16.5%. Canadian housing starts remained unchanged over the same period.

On a year-over-year basis, Albertans paid 6.0% more in December 2022 for the goods and services that comprise the Consumer Price Index (CPI) than in the same month a year ago, while the national average CPI was up 6.3%. In Alberta, all broad categories increased, with Food (+10.0%) and Shelter (+7.6%) increasing the most.

In January the Bank of Canada increased the overnight interest rate to 4.5%, which has helped mitigate inflation by reducing the availability of money and restricting the demand for goods & services. Coupled with this, oil prices are down, and supply chain issues have been moderated, which has brought inflation from a high of 8% to 6%. Because of this, a major increase in interest rates is unlikely, which will bring greater certainty and stabilize the financial lending market. According to the BoC, CPI inflation is expected to decrease to 3% by mid-year. This has, however, started to slow the economy and a recessionary adjustment period is likely, with single-family housing sales taking a major hit, which will increase the need for rental accommodation.

Forecast

Although the economic outlook for the year and beyond is somewhat uncertain, what is certain is that various parts of the world will continue to see destabilization and therefore, Canada will continue to see immigration demand. Federal policy toward immigration is also unlikely to shift by any extreme measure, as all major political parties are pro-immigration.

Economic metrics are indicating that Canada, North America, Europe, and much of the Globe will likely see a recession through the tail end of 2023. Inflation, interest rate hikes, monetary tightening, supply issues, and oil prices have put significant strain on the economy causing it to slow. However, it is predicted to be short-lived, as labour markets are tight and household & corporate balance sheets appear to be doing okay. There have been job cuts in certain sectors such as the tech industry, but this does not appear to be heavily affecting the Alberta market.

Interest rate hikes appear to have reached or are nearing their peak, which has and will continue to bring greater certainty to lenders & borrowers and will make decision-making easier for businesses both large & small. Repricing of real estate assets will continue to unfold and will stabilize as the volatility of debt costs ease. This stabilization will bring capital investment to the market that has been sitting on the sidelines. Alberta’s pricing has remained relatively stable, as its thriving economy has attracted considerable investment into the province.

Oil prices are likely to stay above $70/bbl over the next two years, which is a positive for Alberta’s economy, royalty revenue, employment rate, and ability to weather the short-lived recession. Alberta is in a good economic position, and whether this will continue will depend largely on policy toward federal overreach and political shifts. Alberta’s net migration numbers indicated previously reflect its economic prosperity. However, regardless of its economic situation, Alberta is also desirable because of its affordability and quality of life, which is attractive for young families and immigrants.

Price Trends

Demand for multi-family assets has put significant upward pressure on prices. Major players that are willing to pay cash have bypassed interest rate hikes, and although there is still significant capital on the sidelines, multi-family product continues to be an attractive asset for the capital that is in play. With the significant rise in migrants and a strong rental market, it is easy to see why investors are looking for multi-family assets to be a large part of their real estate portfolio.

Transactions

YEAR AMOUNT NO.

2020 $536,548,200 49

2021 $1,152,677,320 70

2022 $1,800,379,339 72

The above chart indicates an increase in the overall value traded in Edmonton through 2022, which indicates a significant appetite for the product despite interest rate hikes.

Vacancy

Vacancy in Edmonton continues to push downward to pre-pandemic levels of around 5%. It is currently hovering around 6% from a high of 8% in 2021, which must be considered with the fact that there has been a significant amount of new supply entering the market, indicating that demand has continued to fill inventory. As migrants continue to enter the province, we will likely see vacancies drop to below 5% by the end of 2023 until lagging construction projects come online.

Cap Rates

The high demand for multi-family product has put downward pressure on cap rates, however, high-interest rates have moved many participants to the rental market, increasing yields and putting upward pressure on cap rates. Because many have been pushed out of purchasing, interest rate hikes have reduced the buyer’s market and therefore, have put downward pressure on values. However, within the multi-family sector demand for product from an investor standpoint, as well as demand from occupants, has been so strong that it has put upward pressure on values and downward pressure on caps. Overall, cap rates have increased with interest rates and rental rates, but not to a significant degree.

Edmonton proper: 4% - 6%

Greater Area: 7% - 9%

Lease Rates

Rental rates have been specified for one-bedroom apartments, which will vary depending on several factors such as location, building amenities, and the age of the building.

Based on historical data, the rental rates per month for a one-bedroom apartments in Edmonton range significantly from:

Northwest: $800 - $1,500

Southwest: $900 - $1,600

Northeast: $800 - $1,300

Southeast: $900 - $1,500

Central: $800 - $1,500

It's important to note that rental rates will fluctuate and vary depending on the current supply & demand of multi-family development in the area, as well as other factors such as seasonality and economic conditions. It's recommended that you contact a professional to ensure specific, accurate, and timely data.

Edmonton Office Property Market Report, March 2022

Overview

The office has been a major topic of discussion for real estate professionals as well as global economists, second only to global supply chain disruption & perhaps inflation. The uncertainty surrounding the future of office space had many contemplating over the last two years whether…

Overview

The office has been a major topic of discussion for real estate professionals as well as global economists, second only to global supply chain disruption & perhaps inflation. The uncertainty surrounding the future of office space had many contemplating over the last two years whether the empty office towers would ever be filled again. The eerie feeling of large empty buildings and an abandoned downtown core gave a sense of a post-apocalyptic setting and the question of if or when the downtown would recover was on the forefront of the business community. Thankfully, most businesses appear to be returning to the office and the downtown may just return to life, although in a slightly different fashion than previously seen.

Market Trends

The meaning of the word “office” and what it represents has undergone a major change over the last two years. The traditional understanding of the office is a physical place of work or productivity. However, due to communication technology and the work-from-home orders this was expanded & shifted into the digital world, which revealed to many businesses, as well as employees that the physical office wasn’t essential to be productive. The virtual company also allowed for companies to expand their employment pool outside their physical location to a global talent pool. Many were predicting the end of the physical office and the collapse of the office market. This, however, was not the case, as the long-term stability of physical real estate assets kept investor confidence and no major panic selling was seen in the market. Most large property owners simply held tight and waited out the storm. What has changed, is our view of the office and the necessary innovation in attracting tenants to vacant space.

For the physical office to survive and to thrive, the definition of the office as a place to do work must expand to a place of wellness, health, social connection, collaboration, creativity, inspiration, and personal development. Because it is not a necessity, the physical office must be a destination that people are eager to go to, as opposed to a place that they are reluctant or forced to attend.

Insights

Companies located in large urban innovation centres have begun outsourcing and establishing smaller hubs in cheaper markets. These smaller cities are attracting a greater innovative talent pool with their affordability and high quality of life. Further, large companies are moving from expensive hubs to more affordable areas due to the decreased need for locational agglomeration economies. For example, Tesla has recently moved to Austin Texas from the San Francisco Bay area and many other large tech companies are following suit. Moreover, talent is opting to live in more affordable areas, causing an even greater exodus of talent out of large hubs. This trend has been seen in other expensive markets such as New York, London, and Toronto. It is unclear as to what extent this will have on office property values in those areas; however, it does seem clear that smaller up & coming cities will experience a rise in employment talent and therefore, the need for office space.

Working from home has presented significant challenges and despite the available technology, home working situations have created distrust between employees and management, have broken down the separation between work & home life, and created overall longer working hours. Additionally, lack of connection, loneliness, collaboration restrictions, and company cohesiveness has also been detrimental to company well-being, productivity, and success. Although there have been reports of anxiety toward the return to the office, most are welcoming it with enthusiasm and according to an Edmonton Downtown Business Association survey, 70% of companies have indicated that they will be returning to the office. It is likely that this number will rise as the advantages of the physical office become re-established. What a 20% - 30% reduction in occupancy will have on property values has yet to be seen. However, what is occurring, is a flight to quality product that contains extra lifestyle amenities, which is in high demand from companies looking to entice employees into the office. This will create upward pressure on higher-end rents and therefore, values of quality, high-end product, and subsequently will put downward pressure on older, lower-end product. For older, lower quality product, mass upgrading & reconfiguration will be necessary to compete in the future market. The reality is that people want to come back to the office but need extra incentive to make the commute, which has motivated many companies to focus on culture, connection, and work lifestyle.

Forecast

Although many will be returning to the office, hybrid working will become the norm as the office becomes more of a luxury than a necessity. This will likely look like three days in the office vs. the five previously required. Further, there has been a trend toward a four-day workweek with an optional day, which has been shown to increase productivity and overall well-being of employees.

Amenities, programming, design, & culture integration into the office experience will be crucial for landlords and developers in a highly competitive market. Such amenities include meditation/prayer rooms, social rooms, gyms, coffee bars, & healthy food offerings. Event programming such as yoga, workshops, lectures, therapy, as well as personal growth classes has become a major draw to current and potential tenants. People have grown accustomed to the comfort of home but are missing the social interaction & colleague comradery. Therefore, comfort, luxury, communal workspace, greenery, and outdoor natural areas will be paramount to the employee experience.

The importance of culture and cohesiveness between employees will also be crucial for businesses occupying the space. Establishing a vivid company vision, mission, and massive transformational purpose will unify & motivate the workforce.

Tenants will be looking for flexible workspace, concessions, and short-term leases, which will increase operating costs for landlords. However, owners should be able to charge higher rents to cover those increased expenses. Many companies will be outsourcing to open talent pools, opting for lean organizational structures that can adapt to changing economic conditions. Virtual components have been integrated into companies and although most companies won’t be entirely virtual that aspect of business is here to stay, which will undoubtedly reduce the number of employees in the physical office and therefore, reduce the necessary overall size of the occupied space.

Alberta is on the rise economically and many people are moving to the province from overpriced markets such as Toronto and Vancouver. International and immigrant buyers are also purchasing homes looking to take advantage of the affordable living and high quality of life. This will have a cascading effect on commercial real estate but particularly on the job market & office absorption.

Market Conditions

As we put the pandemic behind us and see the negative aftereffects of the global COVID-related restrictions, Alberta looks poised for another boom cycle while the world grapples with supply shortages and geopolitical conflict. Production cuts and manufacturing shutdowns throughout the global restriction policies related to COVID-19 have caused significant disruption in the global economic system and created major supply shortages in various industries. Coupled with this, the increases in money supply have caused prices of consumer goods & services to shoot upwards. Canadians are paying on average 5% more than they did last year for goods & services. Major increases in oil & gas prices have been seen in 2022 thus far, with prices reaching $80/bbl in January due to the supply shortage. These supply shortages have been exacerbated by the recent invasion of Ukraine by Russia. This destabilization of Russian oil supply has spiked oil prices to $115/bbl, which is a 55% increase year-over-year. Although this energy uncertainty has slowed global economic activity and further increased the price of consumers goods, the increase in oil price has spurred substantial economic activity within Alberta and drawn attention back to the ethical & stable reserves of the province. Natural gas prices have also been trending to record heights with a 63% increase year-over-year, which has further increased Alberta’s natural gas exploration. As the global & national economy appears to be moving into recessionary conditions, the sense in Alberta is that we are headed for a four to five-year economic run. Alberta’s economy has historically moved in contrast to the rest of Canada and the world when it comes to high oil prices and this time appears no different. Much investor attention has been given to Alberta as of late in real estate, oil & gas, and lumber projects. Many are moving to Alberta to take advantage of affordable living, high earning potential, and good quality of life. This can be seen with Calgary experiencing the busiest day of housing sales in thirteen years on March 1st, with much of the sales coming from people moving from Toronto & Vancouver. Housing shortages in the province have increased housing prices by 16% in major centres, year-over-year.

Price Trends

Long-term leases and private lease concessions have kept office property stable through the work-from-home orders and virtual working environments. Some larger central product was disposed of at lower prices; however, this was few and far between. Smaller suburban product did not see many distressed sales and prices have remained relatively stagnant over the last two years.

Transactions

YEAR AMOUNT NO.

2018 $512,564,079 34

2019 $875,663,500 24

2020 $235,338,917 31

2021 $78,062,000 22

The above chart indicates that office sale volumes in Edmonton have been relatively on par throughout COVID as 2018 & 2019. However, the total value of the transacted product is significantly lower, which indicates that the product being traded is smaller, lower-priced property. What this says about the market is that the larger investors sat out most of the pandemic due to low-risk appetites and shareholder obligations. It was the smaller players that were doing the deals throughout the pandemic, which is reflective of smaller investors being more adaptable, agile, and willing to take on greater risk to reap the benefits of slightly lower prices and distressed property owners.

Vacancy

CBRE is reporting that suburban vacancy rates dropped 20 basis points in Q4 of 2021 from the year prior. Downtown product was hit much harder by the government-imposed restrictions, increasing vacancy by 50 basis points. Overall vacancy is hovering around that 20% - 22% marker. This rate is expected to decrease significantly over 2022 as companies return to the office. These numbers represent a short-term market dip and are not considered to be stabilized or normal vacancy rates. As mentioned, the higher quality AA product is experiencing lower vacancies at 15% in Q4, 2021, whereas the B class product is clipping 40%.

Absorption

The suburban office market saw 100,000 sq.ft. of positive absorption through the second half of 2021. AA product saw a positive absorption of 29,000 sq.ft., which is an indication of the flight to quality previously mentioned. Overall, however, the office market saw 200,000 sq.ft. of negative absorption through 2021, as uncertainty about the future was at its height. Figures through 2022 will likely see significant positive absorption as most companies return to the office.

Cap Rates

Office properties have been one of the more negatively affected assets in the real estate market and are considered to have greater investment risk than other asset categories. Long-term leases that were in place prior to 2020 and lease concessions have pulled the office market through complete disaster and the office market is starting to reinvigorate itself, with the return to the office looking promising. However, there is still greater risk in the market than pre-pandemic levels, which would warrant higher capitalization rates. The risk is largely dependent on the individual attributes of the property and each property needs to be carefully analyzed and studied, as market capitalization rates have a significantly large range. However, general rates are listed below.

Edmonton proper: 6.5% - 7% Greater Area: 7% - 7.5%

Lease Rates

Lease rates have seen a significant spread between high-quality product with amenities and older lower quality product. High quality has been trending upward, while low-quality has been moving downward.

The following is a rental rate survey for various areas located on the “Edmonton Real Estate Zone Map.”

*These lease rates are an accurate representation of the general area but may not be accurate to a specific property within the area.

*Lease ranges are largely dependent upon the age, condition and amenities displayed on the property. *Lease rates are on a price per square foot & triple net basis.

Edmonton Real Estate Zone Map

DOWNTOWN CORE (Zone 12)

Low $10

Mid $16

High $35

EAST CORE (Zone 13)

$14 - $24

NORTH CENTRAL (Zone 5, 8)

$8 - $15

SOUTH CENTRAL (Zone 15)

$6 - $12

CALGARY TRAIL

$28 - $36

WHYTE AVENUE

$22 - $25

WEST CENTRAL (Zone 4, 7, 10, 11)

$8 - $13

EAST CENTRAL (Zone 17, 18, 19)

$10 - $15

SOUTHWEST (Zone 14, 16, 55, 56

$30 - $40

WEST (Zone 20, 21, 22)

$12 - $15

NORTHWEST (Zone 1, 27, 40)

$15 - $20

NORTHEAST (Zone 2, 3, 6, 9, 23, 28, 35, 43, 50, 51)

$20 - $28

SOUTHEAST (Zone 29, 30)

$18 - $20

PARSON & CALGARY TRAIL COMMERCIAL AREA (Zone 41)

$15 - $20

SUMMERSIDE/ELLERSLIE (Zone 53, 54)

$18 - $20

ST. ALBERT

$15 - $30

SHERWOOD PARK

$15 - $23

SPRUCE GROVE

$14- $26

LEDUC

$14 - $21

Edmonton Retail Property Market Report, October 2021

Overview

Retail assets have been a major topic of discussion within the real estate community over the last year and a half, as these assets have faced significant disruption due to the COVID circumstances. The stay-at-home orders have directed shoppers online and shifted consumer preferences. This has led to the neglect of…

Overview

Retail assets have been a major topic of discussion within the real estate community over the last year and a half, as these assets have faced significant disruption due to the COVID circumstances. The stay-at-home orders have directed shoppers online and shifted consumer preferences. This has led to the neglect of physical retail locations, which has increased vacancies and caused property values to decline in some areas. Coupled with this, the central business districts of major centres have been left desolate, which has greatly affected the demand of retail space, not only in those office districts but on commuter routes as well. Further, the economic disruption has increased income inequalities, compounding the effects on the consumer-driven economy and overall societal well-being.

Market Trends

With so many keeping to their local area, retailers that weren’t dependent upon office workers, suburban tourism, or commuters have weathered the COVID storm much better than their competitors in other areas. If working from home persists and this trend continues, we could see the resurgence of neighbourhood shopping centres. It is unclear what the future of office holds but it appears that many companies will allow employees to work from home at least part of the week, which will have a ripple effect on the demand for retail space in core areas and local neighbourhoods. In modern times, the neighbourhood shopping centre had fallen out of fashion, however, because people have been isolated to their localities, it seems the demand for this property type has increased. On the other side of this, central areas have seen vacancies spike to record heights. To what extent this trend will continue will depend largely on the return to the office and the overall willingness of people to return to the public sphere.

Insights

The restaurant and bar industry has been hit particularly hard by the government-imposed measures. Because of this, many establishments have closed their doors causing vacancies to increase and retail property values to decrease. Many landlords, however, understand the damage that excessive vacancies could have on the value of their asset and understand the costs that are incurred with extended vacancies & lease-ups. This has motivated many landlords to grant rental rate reductions and abatements to help tenants weather the current conditions. Contracts are being implemented that would allow tenants to compensate for the reduced rental rates with higher future rates over an agreed-upon term. The idea is that property income over the investment period would not differ greatly than forecast levels and therefore, the property’s current value would not decrease significantly, as property value is determined by the present worth of future net income. These creative strategies have allowed retail property to remain a stable asset for investors. Those that understand the long-term nature of real estate and are capable of innovating have demonstrated resilience, while others that are not capable of withstanding short-term market shocks have been pushed out of the market.

Forecast

Post COVID, emphasis on the overall experience will be paramount in attracting consumers to physical locations. With the acceleration of e-commerce, retailers will likely need an entertainment edge to entice people to leave the house. What this will look like is in the hands of the creative ingenuity of entrepreneurs, the adaptability of businesses, and the courage of landlords to implement new ways of operating. It is likely that those that are the most innovative will come out ahead of those that assume the retail world will go back to the way it was. Examples of how this might play out has come from China, where retailers are taking chances on unexpected or non-traditional occupants. Chinese electric car companies have started to occupy mall and shopping centres to connect directly to shoppers outside of traditional car dealerships. It may seem strange, but this is perfectly on brand for the innovative and novel characteristics of the electric car industry. This concept has also been expanded to “lifestyle” stores such as homeware, beauty, personal improvement, pet-shops, & bookstores. The goal is to create a space where people can linger and hangout, as well improve the mood of the customer. The shift in consumer preferences has been toward products and services that help people feel better, which includes the space and branding behind the product. People appear to be eager to return to the public sphere and reinventing space to make it more inviting will be crucial in a highly competitive market.

Market Conditions

Retailers in Alberta have been hit hard by the COVID-19 economic conditions, as government-imposed business restrictions and mandates continue to deter consumers from in-store offerings. Since a drastic decrease through 2020, retail trade on a dollar amount basis appears to have recovered. However, this is likely due to inflation caused by excess money printing related to government handouts, and global supply/supply-chain issues, which have increased the cost of goods. The consumer price index, which tracks changes in prices, has increased to 4.7% in August compared to the average of 2% per year. This upward trend in the price of goods & services is likely to continue as economies continue to open and the effects of an increased money supply take hold.

Supply shortages have occurred in nearly all sectors, which has significantly reduced quality of services throughout the world. Further, oil & gas prices are continuing to rise, which has put increased pressure on supply-chains and the cost of goods.

As previously mentioned, restaurants have taken the brunt of the government-imposed restrictions and mandates. Because of this, restaurant revenue has plummeted in Alberta through 2020 and into 2021. During Alberta’s open Summer, sales nearly recovered to normal levels but have likely dropped once again due to government mandates.

The retail sector has significant challenges to overcome in the foreseeable future and the sector presents the greatest risk moving into 2022. However, retail property owners are still managing to maintain occupancy and value in their assets.

Price Trends

Prices for retail space have dipped with significant enough distressed sales on the market to decrease overall asset values. However, we have not seen the carnage that many alarmists predicted. Private investors pushed the market forward through the depths of the COVID orders, taking advantage of low prices during high-risk periods. More recently, institutional investors that were quiet through 2020 and early 2021, have rejoined the market and been active in seeking out price points below pre-COVID levels, which was likely their strategy from the start of the recent circumstances. This has brought upward pressure on prices, which has created a balancing effect on values.

Transactions

Retail sale volumes in the Edmonton GMA have been relatively on par throughout COVID as the same period in 2019. However, it should be noted that 2019 was not considered to be an active market. Further, 2018 was also not considered to be an active market but had higher sales volumes than 2019. Although sale volumes are steady, the market is still considered to be recessed. On a more positive note, both 2020 and 2021 had larger transactional dollar amounts than 2018 and 2019. This is an indication of larger product movement and bigger players entering the market. Many of the higher-priced properties sold in 2020 & 2021 included shopping centres and automotive dealerships.

Vacancy

Online options have allowed many businesses to subsidize their physical location losses, which in-turn has permitted many to continue their in-store offerings. However, retail vacancies are continuing to crawl upwards as businesses continue to struggle through restrictive measures and mandates.

Overall vacancy in Edmonton is 7.6%, up from 5% in 2019, with the central core being hit the hardest at 15.4% and other areas in the city ranging from 5.1% to 6.4%. As previously mentioned, Neighbourhood Centres and Suburban Power Centres have the lowest vacancies at 4.2% & 3.5% respectively, with Street Front and Regional Malls representing the highest vacancy category at 15.3% & 9.2% respectively.[1] This is representative of a lack of foot traffic in core areas and an increase of localized neighbourhood demand due to work-at-home orders.

Absorption

Leasing activity improved through 2021 compared to 2020 but is still down 20% when compared to 2019. The central core areas continue to be slow, as peripheral areas display the greatest absorption. Malls have experienced the largest increase in availability.[2]

Cap Rates

Retail properties have been one of the more negatively affected assets in the real estate market and is considered to have greater investment risk than other asset categories. Government aid packages and record low interest rates were implemented to act as mitigating factors, which has attracted private investors to the sector. Coupled with this, the volatility of the stock market and low yields in the money markets have driven capital to commercial real estate as investors look for a more stable risk weighted return for their money. This has created a balancing effect, and thus far only minor increases in cap rates has been seen within the retail sector.

Edmonton proper: 6% - 6.5%

Greater Area: 6.5% - 7%

Lease Rates

Although asking rates had dipped significantly, this was short-lived and representative of the desperation of the initial economic shock. Overall, however, rents appear to be stabilizing and trending back to pre-COVID levels.

[1] CBRE: Market View, Edmonton Retail, H1 2021

[2] JLL: Edmonton, Retail Outlook, Fall 2021

Edmonton Market Report, November 2020

Overview

We are currently in a price discovery phase in which most vendors are reluctant to sell, and purchasers are paranoid of overpaying. Coupled with this, banking institutions are hesitant to lend despite pressure and incentives from the Government. The perceived uncertainty presents a significant risk to…

We are currently in a price discovery phase in which most vendors are reluctant to sell, and purchasers are paranoid of overpaying. Coupled with this, banking institutions are hesitant to lend despite pressure and incentives from the Government. The perceived uncertainty presents a significant risk to lenders who are already experiencing the fallout of businesses going under and being stuck with bad debt. As previously mentioned, this creates a less-active market, which could include forced or distressed sales, which do not give an accurate depiction of fair market value. Real estate markets take time to adjust to economic fallouts and will filter into valuations over the course of the year. However, real estate fundamentals remain strong, and it is unlikely that they will take a significant hit over the medium term. Valuations may decline in the short-term within some sectors however to account for the uncertainty and risk perceived in the market. Because COVID is an external environmental force, once the issue has been resolved business should return to a “new normal” and property values will recover or rather stabilize at levels that are congruent with the economic recovery. The lower transaction volumes and short-term nature of the circumstances would make any short-term drop in values insignificant to investors who understand the long-term stability of real estate assets.

Sale volumes over the first half of the year did not experience any significant decrease through all property types, except office transactions did slightly dip. This is due to the ample amount of office space that came onto the market with the completion of Stantec Tower and the JW Marriott building. These stable numbers can be attributed to negotiations prior to the COVID crisis. Real estate transactions tend to lag the market, as they are negotiated three to six months prior to the completion of the contract. More recent data through August, September, & October reveals a different story. Data from these three months shows a significant decrease in activity within the retail, office, & industrial sectors. Retail transactions dropped 50% year-over-year in October and 75% in September, indicating a relatively “frozen” market within these asset classes. The instability of global oil prices has also impacted industrial movement with the market slowing 25% - 55% over the last three months compared to last year. Total sale value has also decreased significantly, as there has been far less trading of larger industrial and office buildings.

These data are representative of a market that has come to the realization that the COVID crisis will drag on longer than hoped. It is also representative of public announcements on the number of businesses pulling out of their physical locations with no plans or desire to return in the immediate future. The decrease in volumes does not necessarily mean value will follow suit. What it indicates is that market participants are taking a “wait & see” approach to the retail & office sector. Improved multi-family property and commercial land on the other hand have remained relatively stable. Multi-family assets, as well as land are seen to be resilient investments with stable long-term returns and appreciation. People will always need a place to live, and with the rise of remote working, people need a suitable environment to live & work, which will likely increase demand for housing with additional space. Although migration is non-existent in the current climate, immigration is expected to return to previous numbers through 2021. Sale volumes for single-family residential property have increased 35% in September year-over-year, with price trends increasing with it. This can be attributed to the record low interest rates and pent-up demand from the spring lockdowns, as well as the desire for hard assets in times of economic instability.

There is optimism within the real estate community that vacancies will be filled when restrictions are lifted through 2021. My professional opinion is that human adaptability and creativity will find use in the available space once the circumstances have subsided.